Financial Management Services Powered by Automation

Having a hard time believing your numbers? Doing “bank account” bookkeeping to keep score?

Constantly late taxes or owner statements? Numbers not lining up?

There is a better way…

We integrate PMS financial data with leading accounting software and keep your books on point.

Numbers you can trust, at last.

- Diagnostic Audits

- Chart of Accounts

- Bookkeeping Service

- Monthly Financial Reporting

- Monthly Owners Statements

- Setup Financial Formulas

- Connect to Accounting System

- Automate Precise Invoices

- Automate Expense Entry

- Portfolio Analysis

- Scenario Planning Advice

- Periodic Advisory Meetings

- System Level Dashboards

STR Accounting

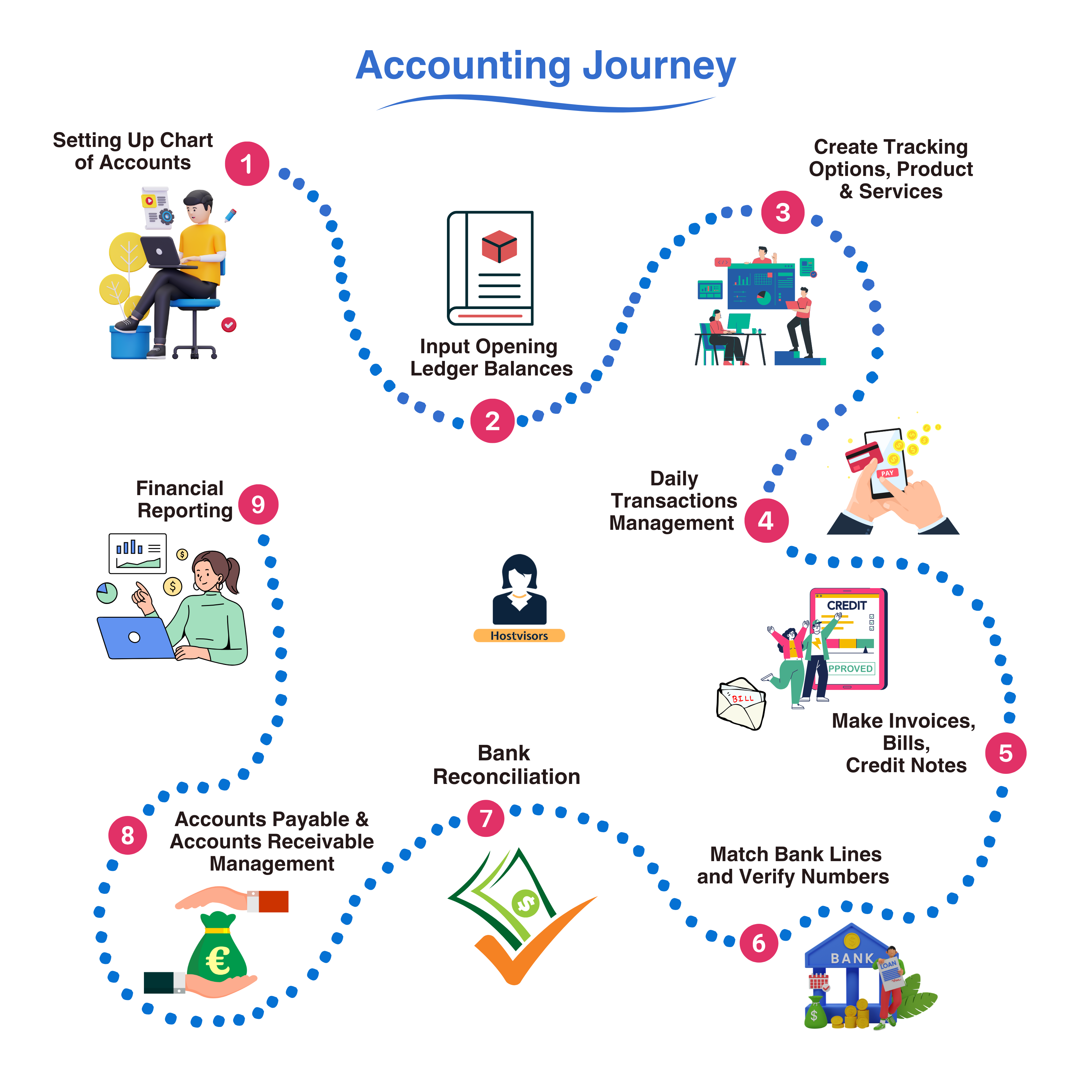

The Accountant's Journey

Within your organization expenses are incurred such as supplies, materials, utility bills, vendor bills, and more. Our system and your Publisher helps automate the assignment of these expenses to each property or owner, giving you faster and more accurate reporting.

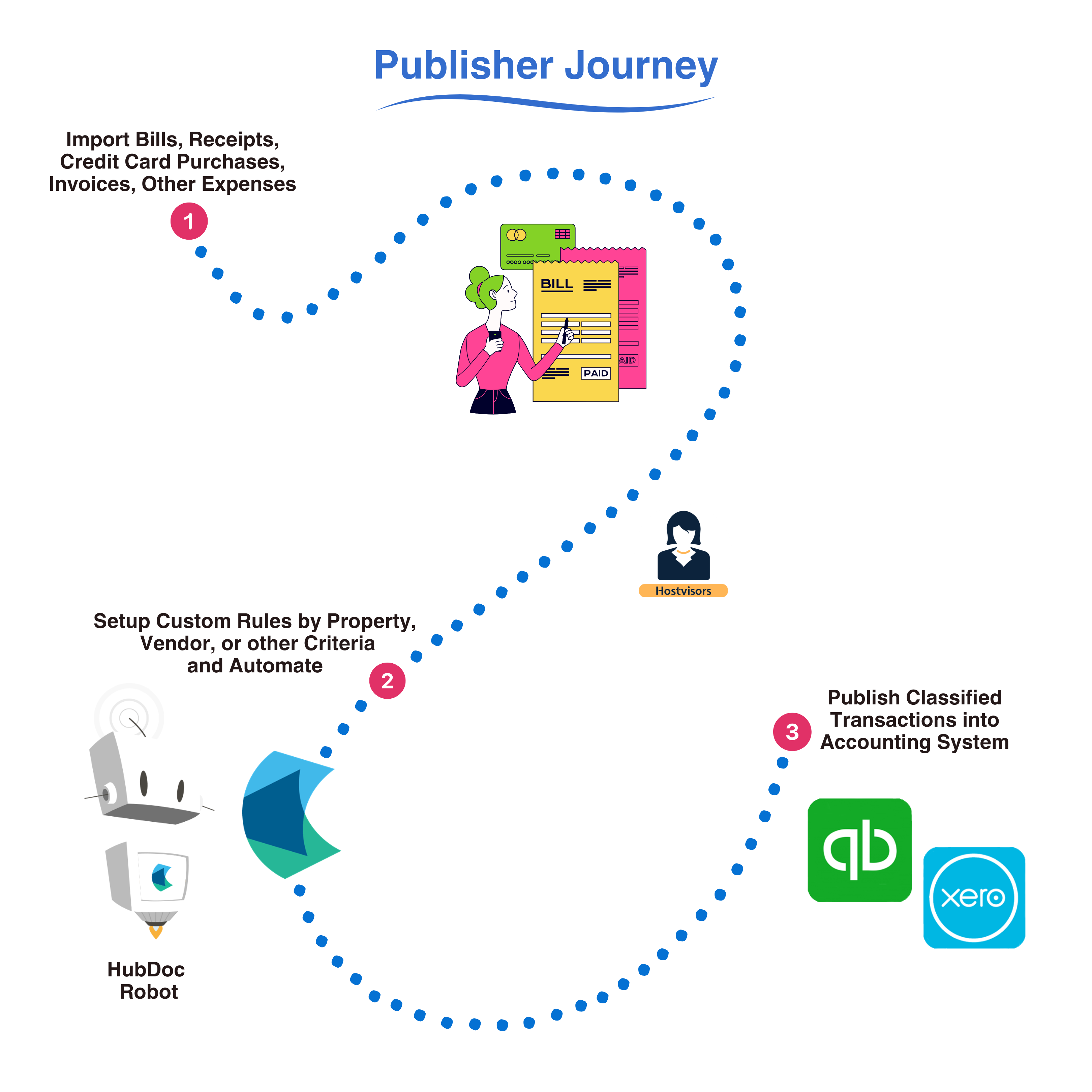

The Publisher's Role

The Publisher collates expense data from across your organization, including bills, credit cards, receipts, and more. The transactions are then organized into an expense management software. The software learns your rules and automatically performs the classifications. This save time each month. The publisher then pushes data to the accounting system landing it correctly by the tracking category/class, representing the property. This process creates a hand-in-glove efficient workflow for the business and the accountant.

A tale of Two Businesses

Property managers looking to scale and eventually exit through the sale or acquistion of their business need to have accurate and reliable financials, documents, and records. The Hostvisors system sets you up for success by addressing all key elements investors and buyers look for. A tale of two businesses compares and contrasts a smooth exit versus a potentially failed endevor. Be ready when opportunity knocks!

| Aspect | Business A (Organized) | Business B (Disorganized) |

|---|---|---|

| Revenue Tracking | Knows profitability of each property | Unsure of which properties are profitable |

| Client Relations | Offers transparent reports and builds trust | Struggles with keeping owners, loses client trust |

| Cash Flow | Stable, with reserves for operations | Unpredictable, leading to missed payments |

| Tax Season | Stress-free with maximum deductions | Stressful, with missed deductions and penalties |

| Scalability | Confidently expands operations and services | Hesitates due to financial uncertainty |

| Business Valuation | High, with clear growth potential | Low, with buyers deterred by financial disorganization |

| Stress Level | Relaxed, focused on growth | Constantly firefighting and stressed |